That said, users new to payroll software and QuickBooks report an enormous learning curve. If you run into a difficulty, there’s a wealth of on-line knowledge via the QuickBooks Payroll tutorial to reply any questions. QuickBooks Payroll offers automated payroll tax submitting on the federal, state and local levels. QuickBooks Payroll is relatively easy to make use of — particularly if you have expertise working payroll or using different QuickBooks packages.

- Dealing with usually tense issues similar to payroll is nowhere close to as complicated because it was, but Intuit makes the job even less complicated.

- Staff can also sue for unpaid wages, benefits, and authorized protections they should have obtained.

- She has additionally earned an MBA and a Bachelor’s degree in Psychology.

- Intuit doesn’t endorse or approve these services, or the opinions of these firms or organizations or people.

- The starting point of our analysis is at all times the core functionality of the software.

- The software program integrates with QuickBooks’ accounting suite, meaning payroll expenses are routinely synced with your books, simplifying account management.

If you join the Elite plan, you’ll find a way to select a callback option to limit the time spent waiting on the telephone. Notably, Intuit outsources HR help to a third-party company, Mineral. This is worth contemplating if you plan to add the company’s HR providers to an present payroll account.

How We Check & Score Our Tools

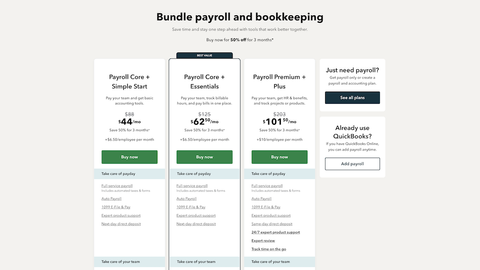

Our aim is to help businesses in choosing the proper payroll service. QuickBooks Payroll from Intuit is a cloud-based payroll service that you need to use stand-alone or in integration with QuickBooks Online. The stand-alone payroll processing service has enough https://www.intuit-payroll.org/ features to handle payroll for one to one hundred fifty staff.

As Soon As you set up your organization’s payroll data, together with worker particulars, wage rates, and working hours, QuickBooks Payroll calculates each employee’s paycheck. Lastly, in consideration of all the other criteria, we evaluate the common worth of entry degree plans against the core options and contemplate the value of the opposite evaluation criteria. We evaluation how quick and simple it’s to get unstuck and discover help by cellphone, reside chat, or knowledge base. Instruments and corporations that present real-time assist rating best, whereas chatbots score worst.

Trip And Depart Monitoring

An correct overview of the total payroll costs will help with budgeting and financial planning. Pay stubs give your staff a clear breakdown of their pay, together with gross wages, tax withholdings, deductions, and internet pay. Even if your state doesn’t legally require pay stubs, it’s nonetheless a best follow to offer them. They assist employees perceive their earnings and may scale back the variety of payroll questions you receive. Many payroll techniques mechanically generate digital pay stubs, making this step quick and straightforward. Now that the payroll funds are on their approach to your employees, it’s time to replace your payroll records.

This information will take you through the payroll course of step by step, so you’re confident and ready for payday. If you’re switching from one other payroll provider, we’ll switch your information for you. Plus, we’ll allow you to keep compliant with guided payroll setup and support.

QuickBooks Payroll reviews point out a fancy learning curve, and it’s a bit sophisticated to get arrange. In general, it could be on the advanced facet for novice bookkeepers. QuickBooks on-line payroll evaluations also report that the price is a little steep for small businesses, and a few customers report that the price goes up frequently. Moreover, long wait occasions are reported when calling customer support. QuickBooks Payroll outshines many competitors regarding functionality and obtainable integrations. It also has further options to assist guarantee you can offer aggressive payment packages for your staff, similar to benefits and 401(k) administration instruments.

Finest Nanny Payroll Companies In 2024

In the QuickBooks On-line Payroll Core plan, you get full payroll providers meaning they calculate and file payroll taxes. You additionally get auto payroll runs, basic product help, and next-day direct deposit. When evaluating the most effective payroll services, we spent dozens of hours researching the highest on-line payroll companies.

You’ll wish to keep in mind these rules when determining the way to course of payroll. Don’t forget to reconcile your payroll information and maintain every thing well-documented. That way, you’re prepared for audits and may catch any errors early.

Getting classification proper from the beginning will save you time, cash, and legal hassle down the highway. As Quickly As you have this info, the subsequent step is to transfer it to your payroll software or bank. Processing payroll isn’t just about compensating your workers. It’s a half of working your small business legally—according to state laws and the Honest Labor Standards Act (FLSA). Operating payroll could appear to be a giant task, however when you break it down step by step, it turns into rather more manageable. Observe the 9 steps under to assist hold your small business organized and compliant.